Internet banking has been around for quite some time now and also there is no doubt that it has made banking a great deal a lot more efficient as well as simple. Adoption of internet banking remains to expand day by day. Study shows that the variety of purchases taking place via the internet is anticipated to go across 33 billion by 2012. The variety of online transactions is expanding at a price of nearly 13%, much greater than that for any other network. By 2013, banks expect virtually 20% of sales to be made through this channel. Financial with the web is definitely much more economical and there is a section of customers who like the ease and also very easy accessibility that it uses. Personal economic management tools have encouraged client and also instructed them to handle their financial resources themselves.

While all this is true, there is another channel whose importance can not be understated, and that is the branch. In a recent global research study of retail banking, participants rated the branch as well as the Net as the most important networks. Over the years, financial institutions have actually attempted to relocate customers away from the branch towards a variety of self-service channels, also supplying them incentives to do so. Regardless of these efforts, the branch remains the network of selection for a substantial percentage of consumers. There are a number of reasons for this, not the least of which is mental convenience. The physical environments of the branch as well as the accessibility of staff as well as advisors inspire trust fund as well as self-confidence in financial clients. When they walk right into a branch, they are sure of finding a person to attend to their queries; they take solution for given. This feeling of reassurance is so important to them that they do not mind taking the problem of seeing the branch or waiting in line to be served.

Not surprisingly, an additional current research study revealed that consumer involvement in retail financial - a significant determinant of high quality of experience - was driven extra by emotional, rather than practical factors. At the top of this listing was consumers need to be valued, complied with by their understanding of the engagement level of bank employees. Simply put, clients wanted bank employees to reveal them that they valued their company, and also when needed, go the extra mile to meet their assumptions.

An additional analysis claimed that retail banking brand names need to be mentally lined up with their consumers to win them over. This indicates that banks must attempt to recognize their consumers needs far better by asking appropriate concerns, paying attention meticulously and providing a considerate ear to genuine issues.

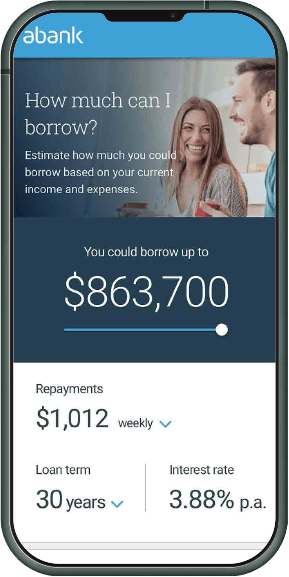

Relocating from the subject of vehicle drivers to obstacles, past research studies have repetitively indicated that problem pertaining to safety is just one of the largest barriers to Internet banking fostering. While this has actually absolutely come down over the last few years with security systems ending up being much more durable, the reality stays that individuals - also Electronic banking customers - are not secure sharing delicate financial information over a site, and also for that reason restrict their task to standard purchases. An additional reason why customers don't do even more via Electronic https://www.sandstone.com.au/en-au/mobile-app banking is that many financial institutions do not supply advising solutions over this channel, additional restricting its function. On the other hand, the branch has constantly been the best option for clients seeking to make a vital monetary choice calling for consultatory input, such as availing a home mortgage or preparing an investment portfolio.

These truths clarify why, in spite of the comfort and also availability of Internet banking and also other online channels, numerous customers still prefer the branch as a channel for banking. Therefore, presumably that replicating the branch experience with various other networks such as the Internet, is a great technique that would go a long way in offering favorable customer experience. The bright side is that banks can, with some initiative, replicate the branch experience - which has achieved success up until now, and also remains to sustain - in various other channels, including the Internet.