All banks and also banks have a Digital Financial system nowadays. However does yours simply cover the basics?

Or have you understood the fast-growing relevance of this channel for your clients and your financial institution's future?

Significantly, it's the network your existing consumers choose to engage with you in. And as the electronic indigenous generation maturates and also the workforce, it will be the only https://www.sandstone.com.au channel they'll utilize-- to research study, apply as well as utilize their financial products and services.

It's time to buckle down about Digital Financial

Your financial institution's future depends upon the importance you place on Digital Banking. Exactly how you prioritise its investment and also just how specialized your teams are to integrating Digital Financial right into their critical decisions.

Without a durable Digital Banking system that can expand with you, respond to modifications and possibilities with ease as well as supply extraordinary service to your clients, you go to threat of falling back your competitors.

Include Open Financial to the formula

When Open Financial starts its staged application from July 2019, your consumers will certainly have the power to alter banks and their solutions-- with the click of a computer mouse or a faucet on their cellular phone.

The obstacles to moving banks will be gone.

So, what will make clients stay with you? Your prices? Brand loyalty? You need to act now to guarantee your consumers choose to remain. As well as those financial institutions that pick to focus on their Digital Financial platform are making the best option.

Terrific expectations

Consumers have terrific expectations of their Digital Banking system. These expectations go means beyond simply examining a checklist of their deals or transferring funds.

It stands to reason you're going for it to meet their expectations, right?

No?

Possibilities are your interior group is just as it is, just to ensure you're certified with laws. They don't have time to scrape themselves, not to mention relocation beyond the outright fundamentals. So you had an knowledgeable partner on board.

A companion that could:

guarantee you were certified

conveniently integrate with your core financial system assimilation

springboard you right into a Digital Financial future so you can always deliver an phenomenal client experience

The essential ingredient

Is Digital Financial on the schedule at most of your financial institution's inner conferences? It's not? It must be.

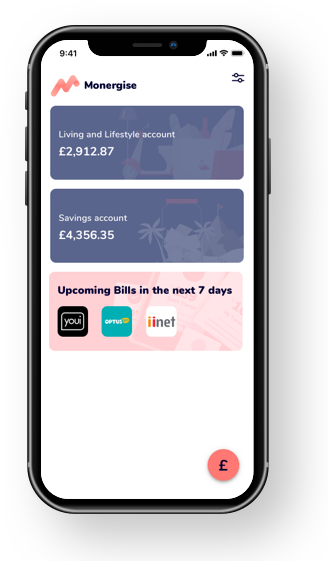

Preferably it should be just one of the very first items on every agenda, because it's the vital active ingredient to your bank's future. As we've noted, your Digital Banking platform is progressively the only place clients connect with your financial institution. Quickly, it'll be the only way you can interact, cross-sell as well as upsell to them. And the only method you can include worth to their experience with education and learning and also devices to equip their monetary management.

Future-proof your Digital Banking technique

It's crucial that you invest in a future-proof Digital Financial strategy. One that is concentrated on increasing as well as keeping uptake of your Digital Financial platform.

As well as you need to get the whole organisation aboard. Your Digital Banking strategy should be driven from the top down and also penetrate with every choice in the organisation.

It ought to remain in your financial institution's DNA.

Open Financial Opportunities

You know Open Financial is below. But in addition to making certain that you're compliant with all the laws, have you considered the possibilities it supplies?

It's time to look at exactly how you can harness the sharing of details that will come with Open Financial. For instance, at a client's request, you could be positive and offer them bespoke deals, based upon an evaluation of their information.

To do this, you require:

an efficient application programs interface (API) to enable protected and also robust data sharing.

the strong foundation of an functional Digital Banking system that is versatile sufficient to grow with you.

and also above all, an knowledgeable partner.

A partner that knows the sector completely. A person that can determine new opportunities, as well as help you make them happen-- from a solid base.

Without this somebody, you could get left means behind in the rush for the possibility market share by well-prepared organisations and brand-new economic children on the block.